AI in Pharma 2025: Who’s Leading the Charge and Why It Matters

- Camilla Costa

- Jul 4, 2025

- 3 min read

Updated: Jul 10, 2025

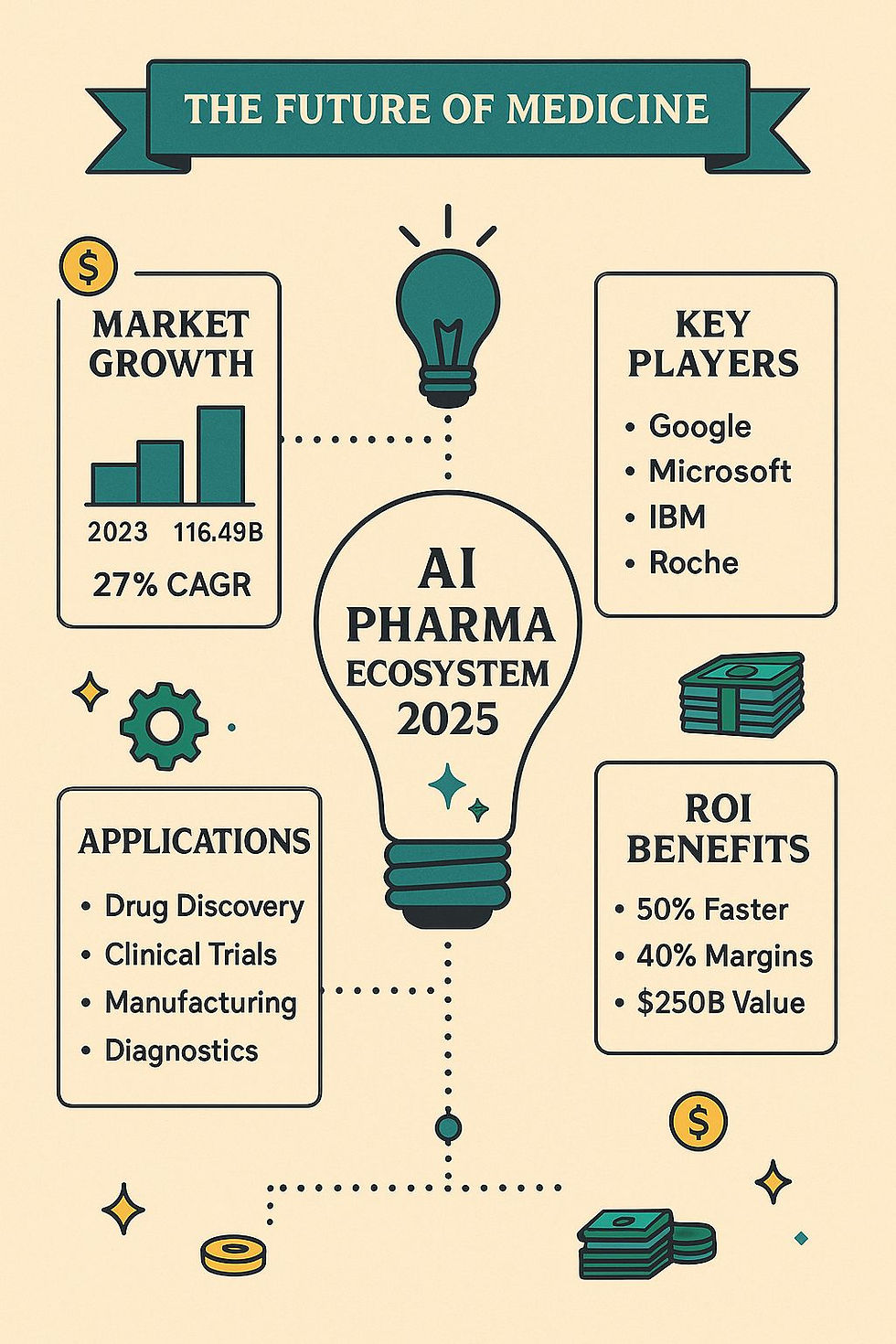

The AI in PHARMA represents the convergence of artificial intelligence and pharmaceutical innovation, and it's no longer a distant vision; it’s today’s reality. With a projected market size of $116.49 billion by the end of 2025 and a 27% compound annual growth rate (CAGR), AI in the pharmaceutical industry is reshaping everything from drug discovery to diagnostics. But what’s behind this growth? And more importantly, who are the key players steering the industry forward?

Let’s take a closer look at four industry giants: Google, Microsoft, IBM, and Roche, and how each is uniquely driving the AI pharma ecosystem.

AI in Pharma: Brief description of the Main Player and the technology used Google: Building Diagnostic Brains, Not Just Search Engines

Google has made a significant shift from search algorithms to clinical intelligence. Its recent releases, like MedLM and Med-Gemini, are setting new benchmarks for healthcare-focused generative AI. These models have been trained on vast datasets and refined for tasks such as interpreting radiology images and supporting diagnosis in oncology and dermatology.

Another breakthrough, AMIE (Articulate Medical Intelligence Explorer), focuses on replicating the thought process of a clinician during patient consultations. This isn’t science fiction; it’s real, and it’s already proving capable of outperforming trained physicians in simulated diagnostic settings.

Their strength? Google’s AI work is centred around a simple idea: better data leads to better decisions. And in medicine, better decisions save lives.

Microsoft: Quietly Powering the Brains Behind the Screens

While less flashy than some competitors, Microsoft’s contributions to AI in healthcare are foundational. Consider infrastructure, scalability, and practical application.

Its new Diagnostic Orchestrator, internally known as MAI-DxO, recently showed an impressive 85.5% success rate on a battery of complex medical scenarios. This tool combines multiple models and clinical inputs to provide more accurate diagnostic insights.

In addition, Microsoft has made significant strides through Azure’s healthcare model catalogue, offering healthcare providers plug-and-play tools that make sophisticated image analysis more accessible and scalable.

Their strength? Microsoft’s quiet confidence lies in making other companies faster, smarter, and more compliant without needing the spotlight.

IBM: From Chess Champion to Clinical Strategist

IBM’s deep roots in AI, dating back to its Watson triumph, are now deeply embedded in real-world healthcare settings. While the brand “Watson Health” may have been divested, its legacy continues through data science platforms designed for health systems, researchers, and life science companies.

IBM’s focus today is less about flashy interfaces and more about behind-the-scenes integration. This includes utilising machine learning to extract insights from unstructured data in electronic health records and applying predictive analytics in oncology, chronic disease management, and population health.

Their strength? Turning messy, siloed data into usable insights that clinicians can trust.

Roche: Merging AI with Precision Medicine

Unlike its tech-native counterparts, Roche brings something they don’t: decades of clinical expertise, access to biological data, and a direct role in drug development. Their recent innovations show just how powerful that combination can be when coupled with AI.

Their digital pathology ecosystem has opened new doors for pathologists to use AI-assisted image interpretation in cancer diagnostics. Roche’s recent FDA breakthrough designation for its VENTANA TROP2 companion diagnostic highlights the real-world potential of this synergy.

Their strength? While others focus on platforms, Roche is laser-focused on outcomes: better diagnoses, earlier intervention, and targeted therapies that actually work for the patient in front of the doctor.

AI in Pharma: What’s the Bigger Picture?

Together, these companies aren’t just innovating; they’re helping to redefine what’s possible in medicine. Their technologies are making R&D pipelines more efficient, speeding up time-to-market for new therapies, and opening up new possibilities for diagnosis and treatment.

We’re seeing:

Development timelines reduced by up to 50%

Operating margins improved by 30–40%

A potential total added value of $250 billion in economic and healthcare system impact

Suppose you’re building in this space. Whether you’re launching an AI diagnostic tool, scaling an algorithm-based therapeutic, or navigating regulatory submissions, it’s crucial to understand how the leaders are setting the pace. Their approaches can offer lessons in infrastructure, validation, compliance, and real-world adoption.

References

Google Health Research: ai.google/health

AMIE Diagnostic AI: research.google/blog/amie

Microsoft Diagnostic AI Tools: Microsoft blog

Financial Times coverage on MAI-DxO: ft.com

IBM Healthcare Research: research.ibm.com

Roche Digital Pathology: Roche Diagnostics

Final Thoughts

We’re at a moment where AI is not just supplementing pharmaceutical innovation; it’s fundamentally transforming it. And it’s not just about machines being faster or wiser. It’s about enabling doctors to make better decisions, getting treatments to patients more quickly, and reshaping the way we define value in healthcare.

Comments